Crack-the-Tax with Sharad Sir

Best Study Material with Super Rich Content & Direct Support - From the Tax Learning Expert

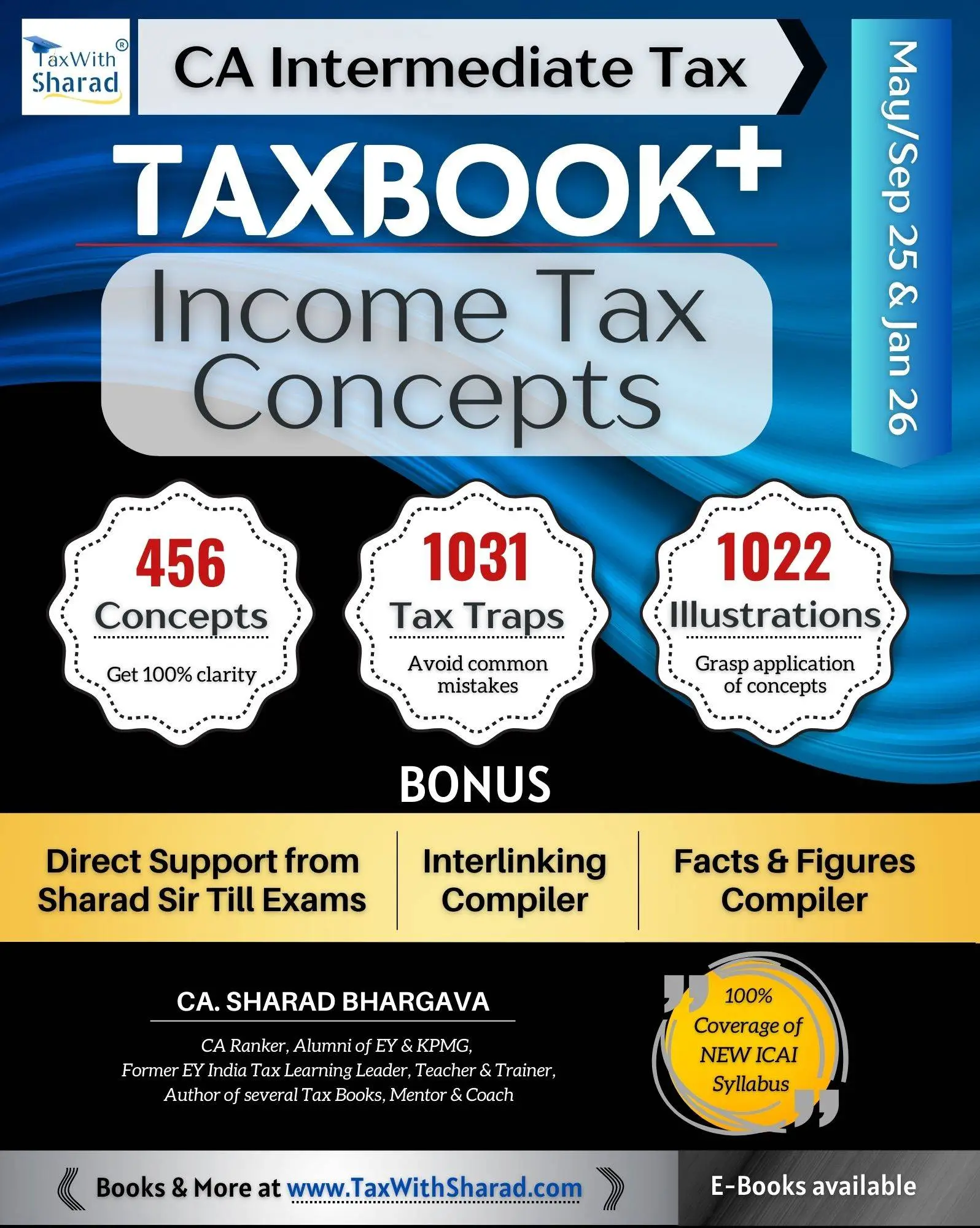

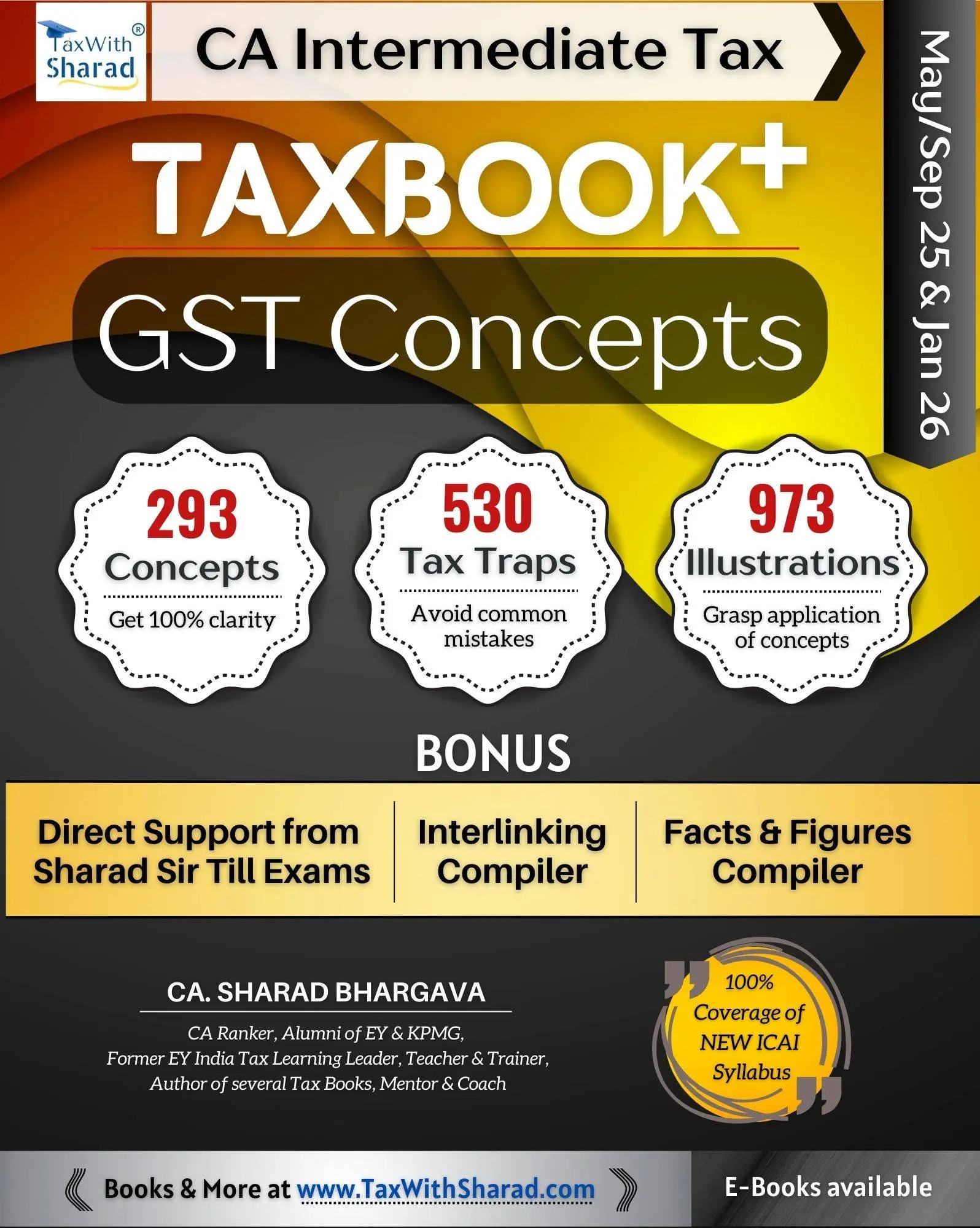

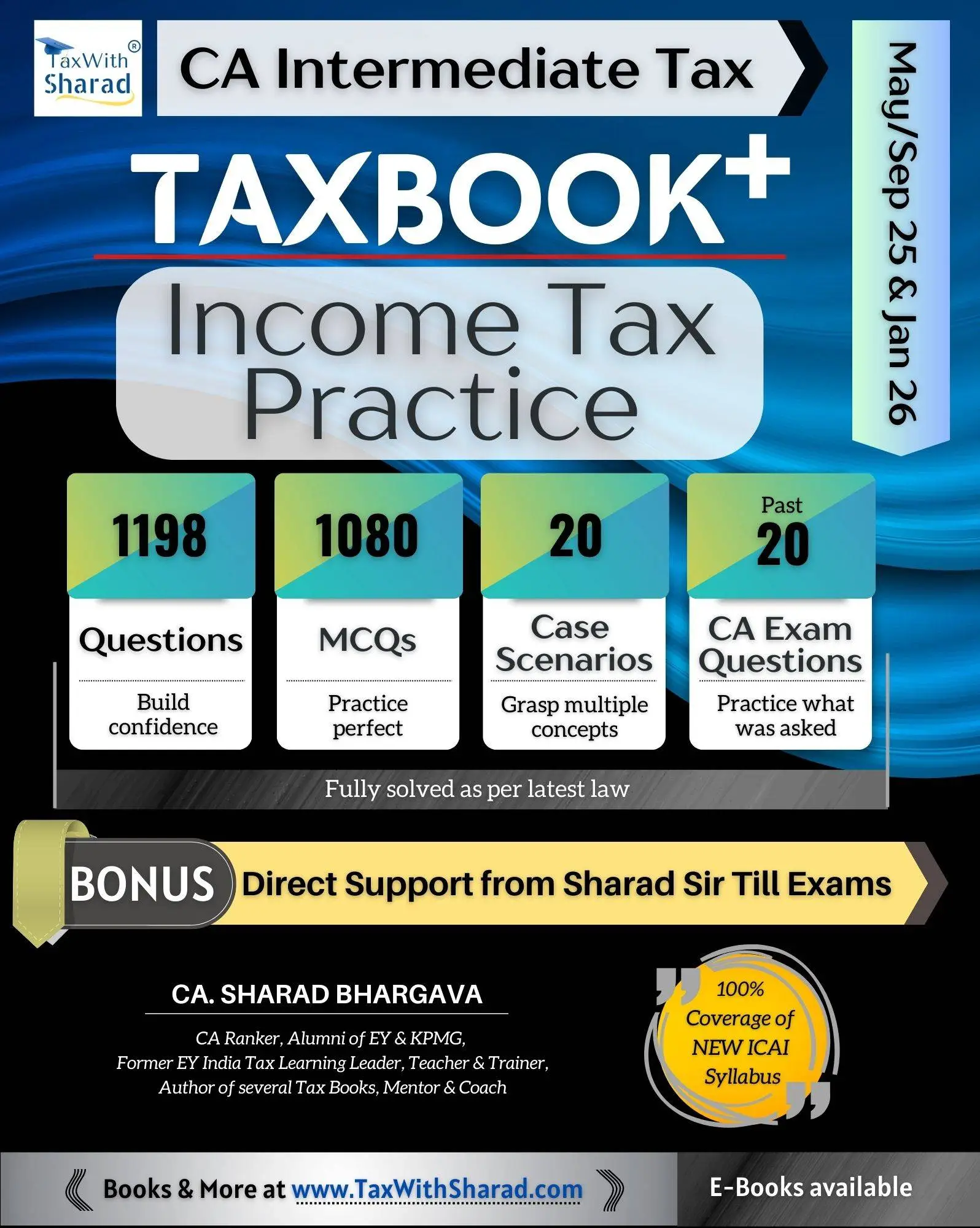

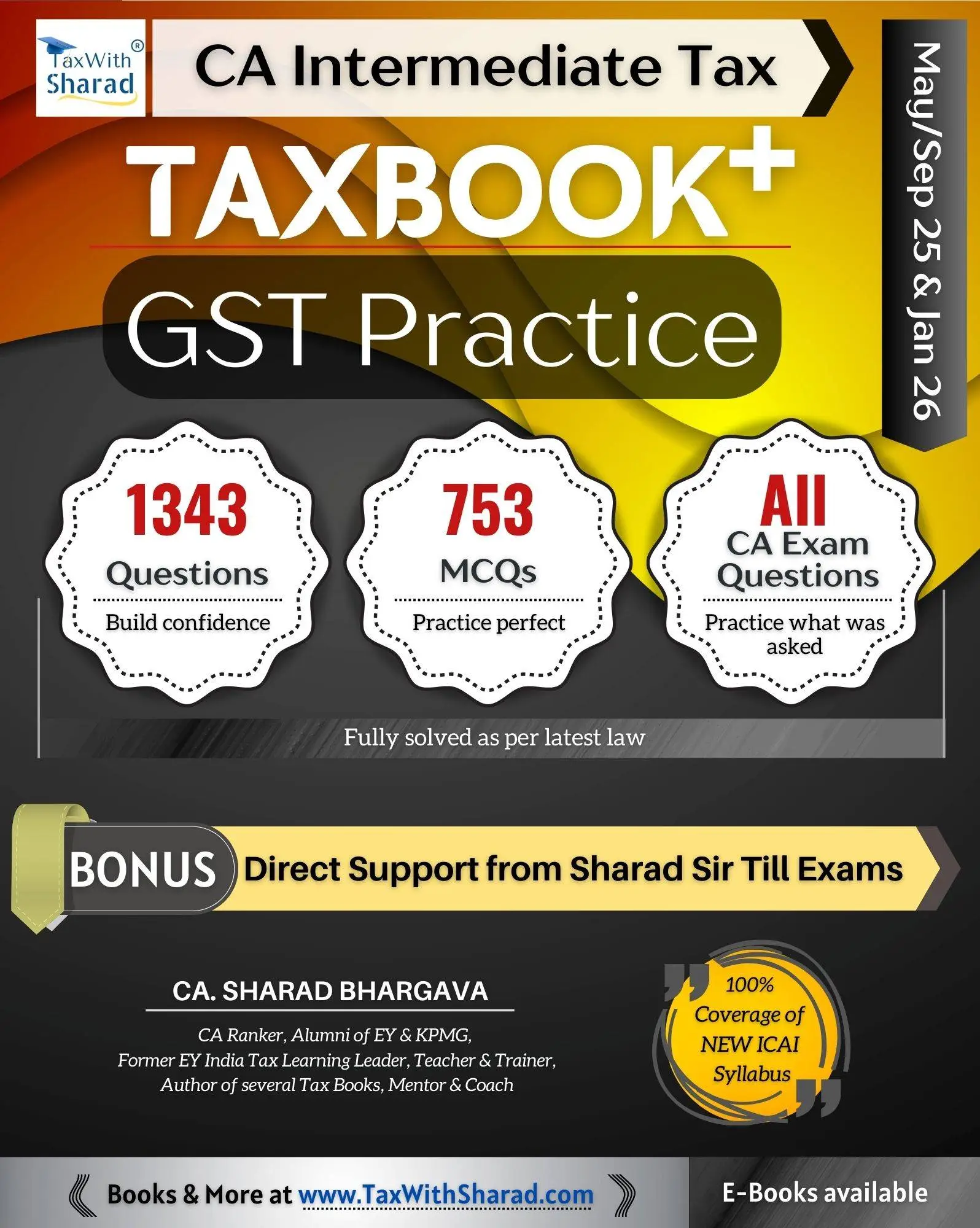

TaxBook+ - The Super Powerful Study Material

Direct Support from Sharad Sir till Exams

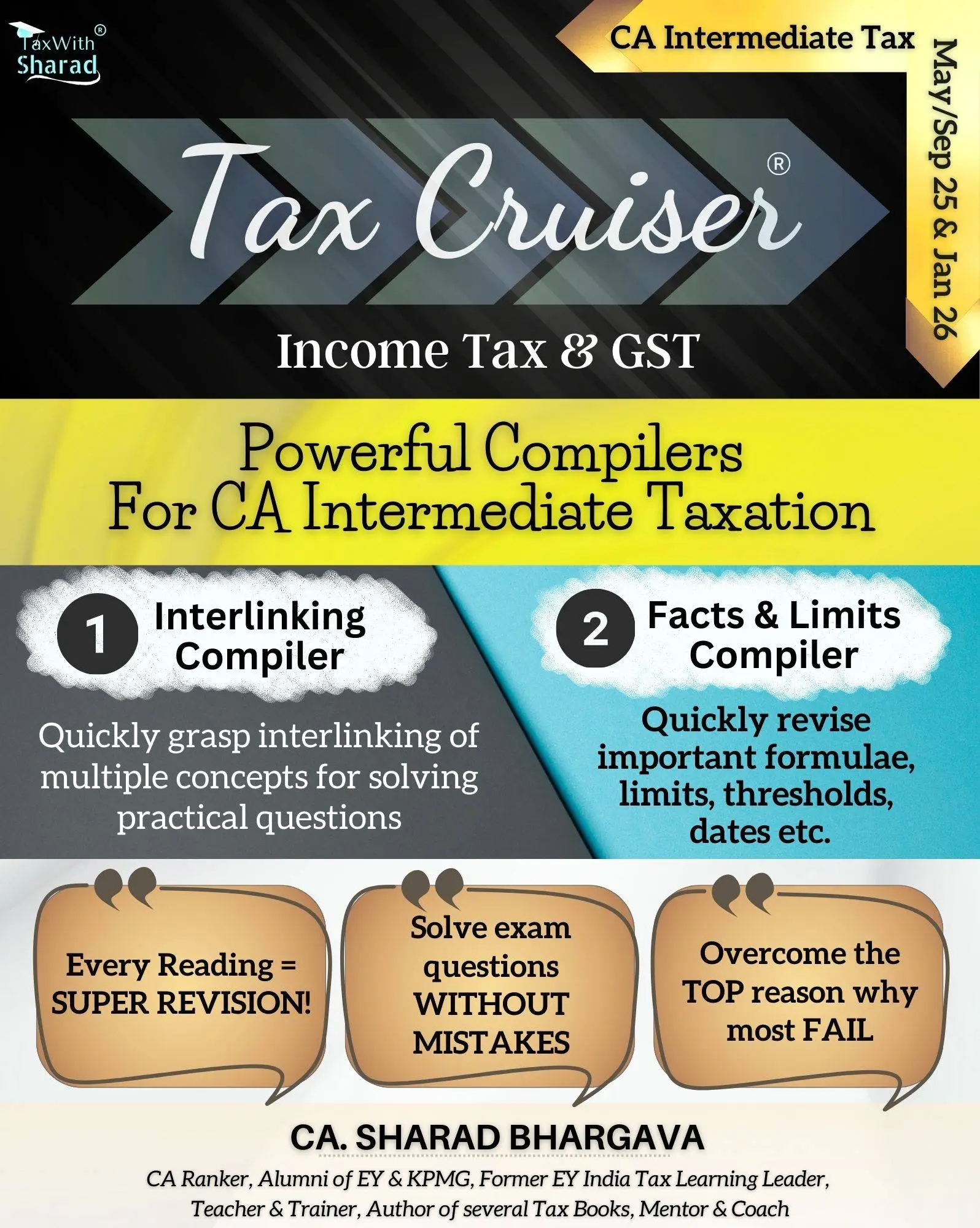

Powerful Interlinking Compiler

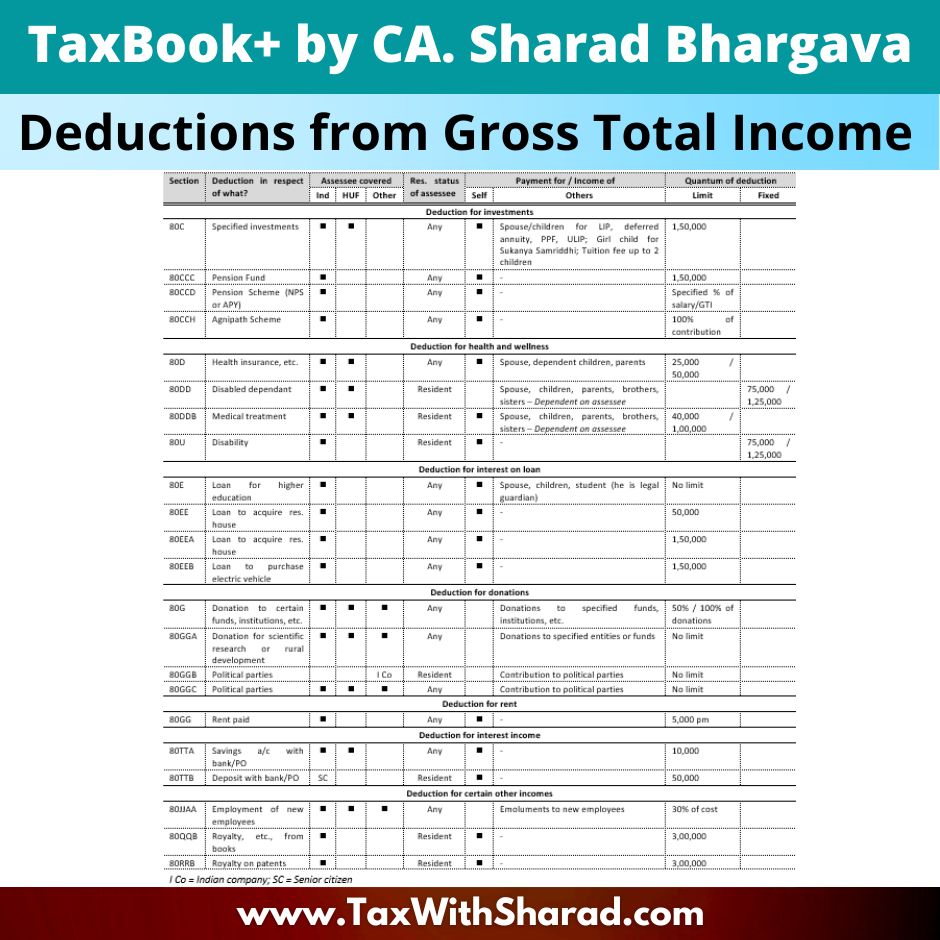

Powerful Facts & Figures Compiler

Video Tutorials on YouTube

100% Coverage of NEW Syllabus

1600+ Pages of Powerful Content

1500+ Tax Traps to Avoid Common Mistakes

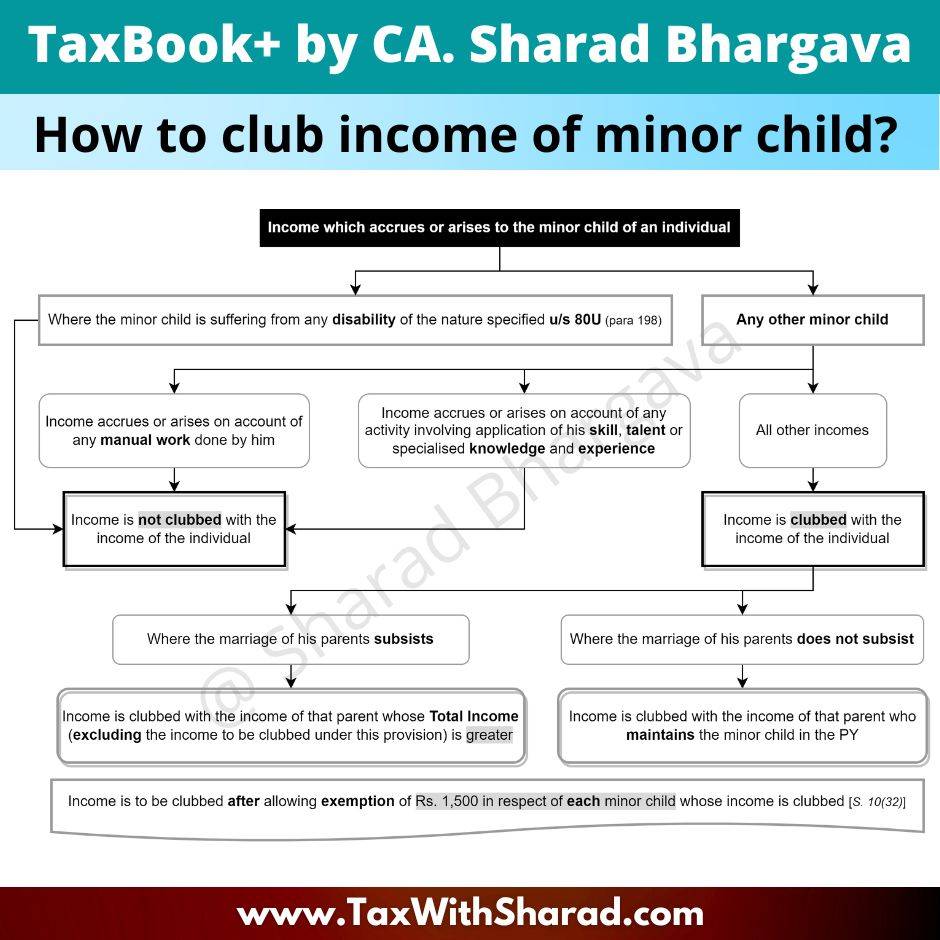

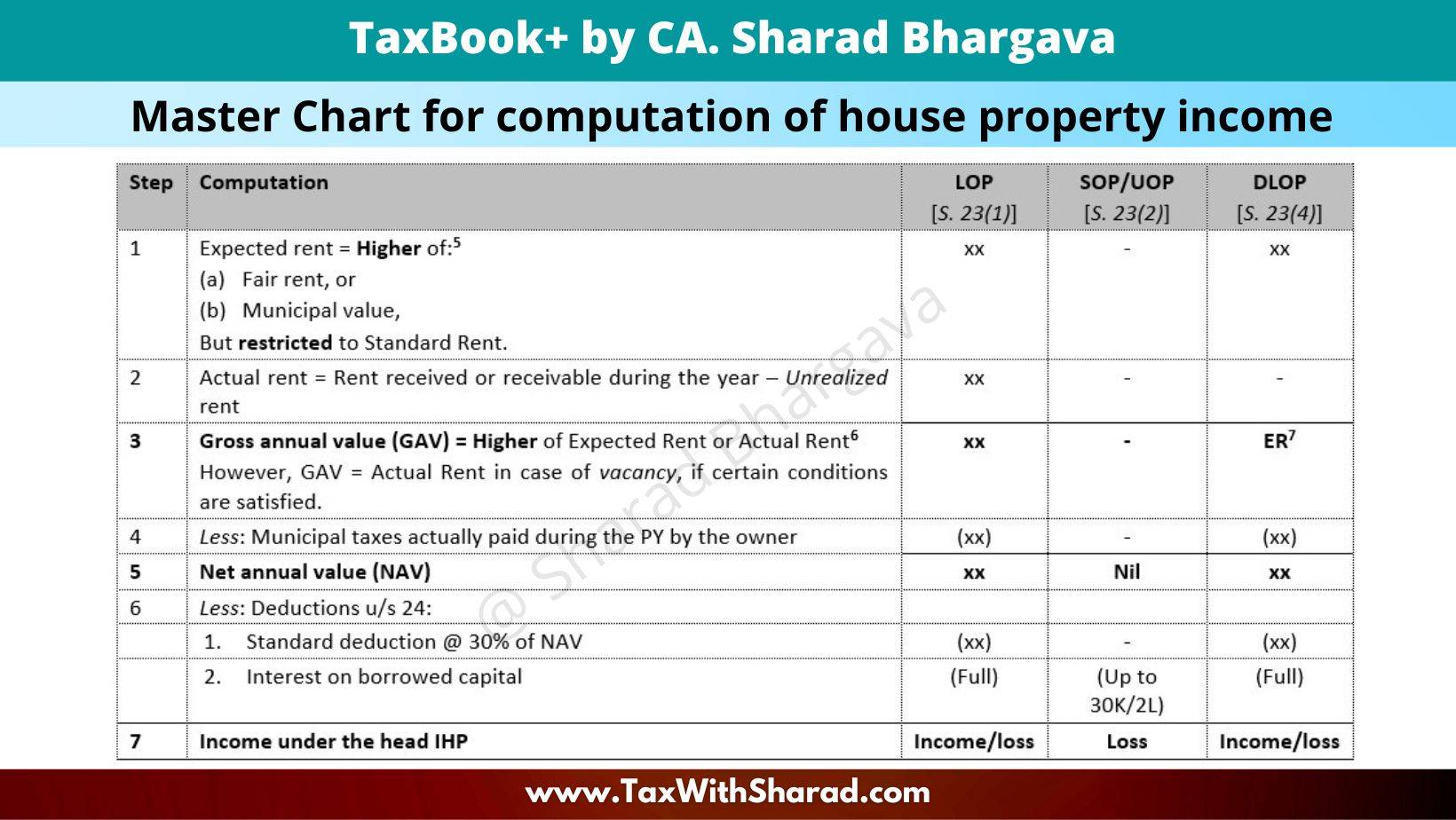

2000+ Illustrations to Grasp Concepts

2500+ Question Bank for Unlimited Practice

Past 20 ICAI Exam Questions (Solved)

1800+ ICAI-style Situation Based MCQs

Case Scenario MCQs to master multiple concepts

Super rich content

Powerful tools to crack exams, grasp concepts & practice. Comes with Tax Traps, Powerful Tax Cruiser Compilers, Video Tutorials, huge question bank & past 20 exam ICAI questions!

Direct support from Sharad Sir

Ask Tax doubts & clear concepts from Sharad Sir till your exams

Updates & Tips

Get important updates & exclusive tips from time to time

By the Tax Learning Expert

CA. Sharad Bhargava - CA Ranker, Alumni of EY & KPMG, Former EY India Tax Learning Leader, Teacher & Trainer, Author of several Tax Books, Mentor & Coach

Testimonials

I cleared my CA intermediate exam in the first attempt in November. I scored 78 marks in taxation and also got an AIR 46. I came across his YouTube channel and I was surprised at how in-depth his explanation was. The same day I ordered the TaxBook+ and from then on, I had no issues with my tax preparation. The TaxBook+ is so precise and clear that I was not left with more than a few doubts which of course Sharad sir cleared in a short time. I would highly recommend Sharad Sir’s books to all intermediate students to greatly facilitate their conceptual understanding in taxation.

The tax book is one of best books I have ever purchased. The extraordinary hardwork, experience and knowledge is fully and clearly evident in every concept of tax laws in the books. The Presentation is at its best. These books are like AC First Class travel to Success in any exam on Tax laws. A good command over English language is the only requirement to benefit from these excellent Tax books to the fullest extent. Outstanding Work. Well done Sir. May god bless you for your great service to students and society. Thank you so much.

I passed in Taxation because of your material. It helped me a lot. Your book structure and the way it is written is the best in the market. Thank you so much sir.

Sir ur material is very comprehensive and extraordinarily drafted.... A lot of research must have been done by you 💯. How much time you devoted to create this material 🤔🤔...

Your tax books are truly amazing—so well-written and super helpful in understanding complex topics (even an ordinary, non commerce background person like me can understand it)

Sharad Bhargav Sir's study material on taxation and GST is an exceptional resource. Its extensive coverage of questions, inclusion of common mistakes, doubt support, visual presentations, and excellent summary notes make it a comprehensive and detailed package. I highly recommend this material to anyone seeking guidance in taxation and GST. It will enable you to confidently navigate the subject and achieve excellent results in examinations.

Amazed to see the clarity in concepts in the book. The learning / retention becomes very easy due to the bullet points, change on fonts, change in shading etc of various important points and the concepts which tend to be confusing. Unlike other books, which mainly occupy the space with bare act kind of language, this book (taxation and the GST) gets deep into the basic concepts which is really what the sutdents want. The difficult/confusing concepts gets further clarified through practical examples (hypothetical), which I have not seen in any other book ever. Usually, after reading the section/provisions, one thinks that they have understood the concept, but after reading the practical examples, one gets to know the exact meaning (which is sometimes very different from what we thought we knew after reading the section bare), and then it becomes very easy to retain in memory for exam/real life.

Sir, you have created such a brilliant book that any amount of appreciation is not enough! While solving questions in the exam, I could feel that I had practiced those in TaxBook....I remembered everything easily. I feel students waste their money on expensive classes - If they self study from your book, EXEMPTION in tax paper is sure. Sir, you have solved all the doubts in such a way that no other teacher does. Thank you so much sir for your guidance, your support till exams. I even called you 30 minutes prior to exam and you solved my doubt. Once again thank you so much sir!

Sharad Sir’s books explains the concepts so vividly that it fulfills the query of an inquisitive student’s mind. It enhances the power of absorbing the subject conclusively. Further if any doubt still persists then Sir is there to resolve queries personally within 24 hours. Above all the intrinsic value of the Youtube Lectures improves the efficacy of a student. Thank you Sir for providing such a treasure for our Taxation paper.

CA Sharad Bhargava's book on income tax and GST concepts is a game-changer for chartered accountancy students. With its detailed explanations and practical examples, it equips students with a thorough understanding of these complex subjects, boosting their confidence and mastery. I highly recommend this book as an essential resource for every aspiring CA.

I am an avid lover of your book. Tax, since I started reading, has been a silent enemy whom I hated or tax never liked me. It is your fantastic book that made me fall in love with the subject. Thanks for your wonderful work.

Great book for conceptual understanding and questions.

I honestly admit your book content is fabulous and highlight is master questions in end of each chapter. Tremendous. Thank you making so much effort sir!

These books have though been written for examination of ICAI, but I think these are very useful for tax professionals too for their day to day practice. Simple language, use of large number of practical examples, incorporation of relevant judicial pronouncements, pictorial representation, Tax Traps are some of the salient features which shall be invariably noticed and appreciated by every sincere reader. Rich taxation experience of the Author can be felt while going through contents of these books. The Author definitely deserves my genuine appreciation for dealing with the subject-matter in such a wonderful way. I wish and pray for great success for publication of these books.

To be very honest I read Income tax from as many books as they are available in the market incl Notes by pvt coaching Institutes. But in vain. When I read your book i understood in 1 go. You distil the concepts in such a way that it gets glued in your mind.

The most systematic, logical, relevant and exhaustive book available on Income Tax for the purposes of understanding each concept clearly, supported with examples, followed with MCQs and thus exam oriented best book for any student to have for thorough reading and passing the exams.

TaxBook+ is awesome sir. Its really great. Beautifully framed!! And tax cruiser is like a super hit!! Thanks for providing such great content.

Your book is fabulous for practice and remembering section content.

I am following your book of direct taxation. It's really good for understanding concepts. Great learning from your book.

Learning Never Stops

Tax Refresher Videos

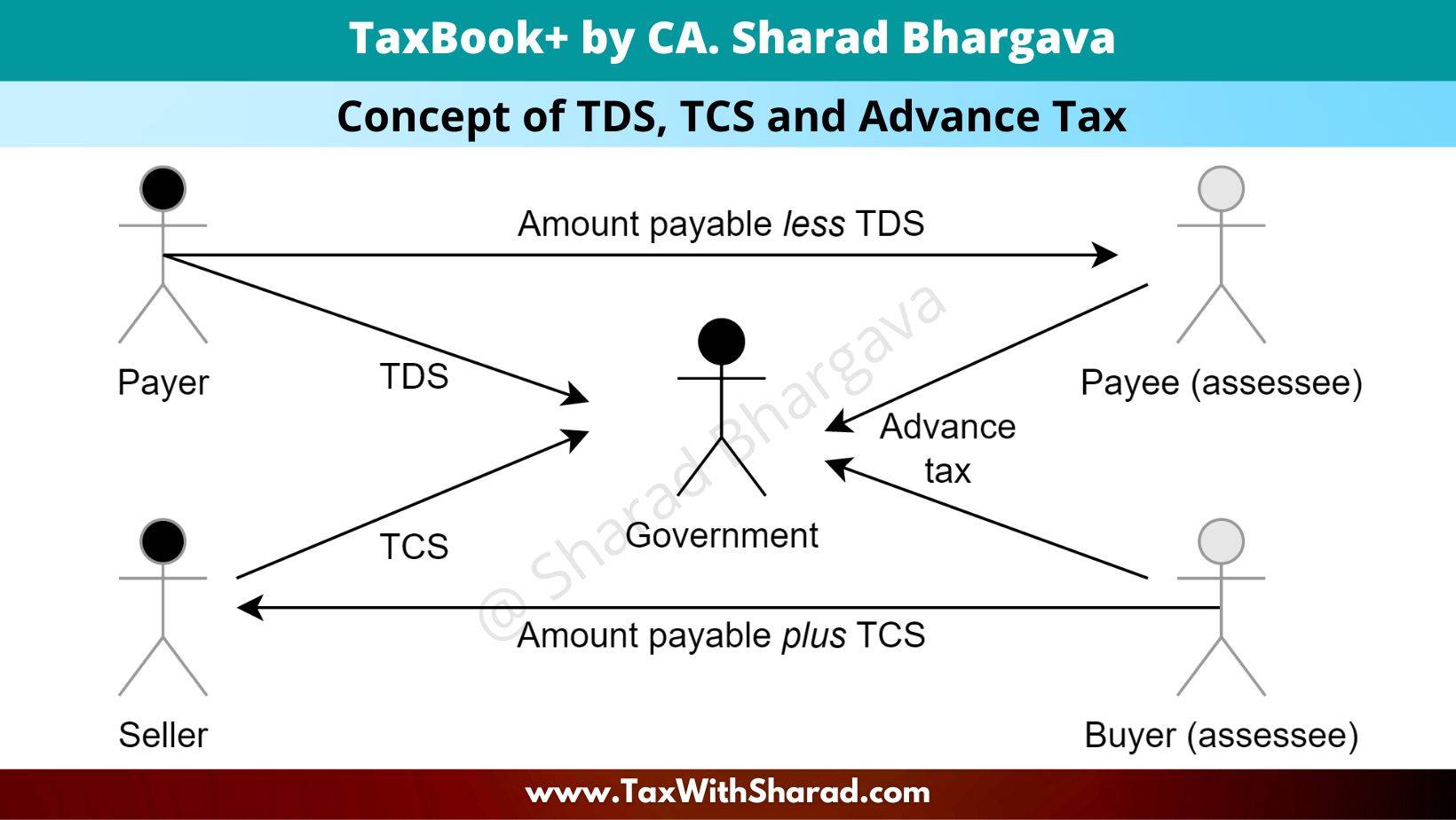

Fast Track Revision (DT) / 14 - TDS, TCS, Advance Tax / CA Inter May/ Nov 2023 / CA. Sharad Bhargava

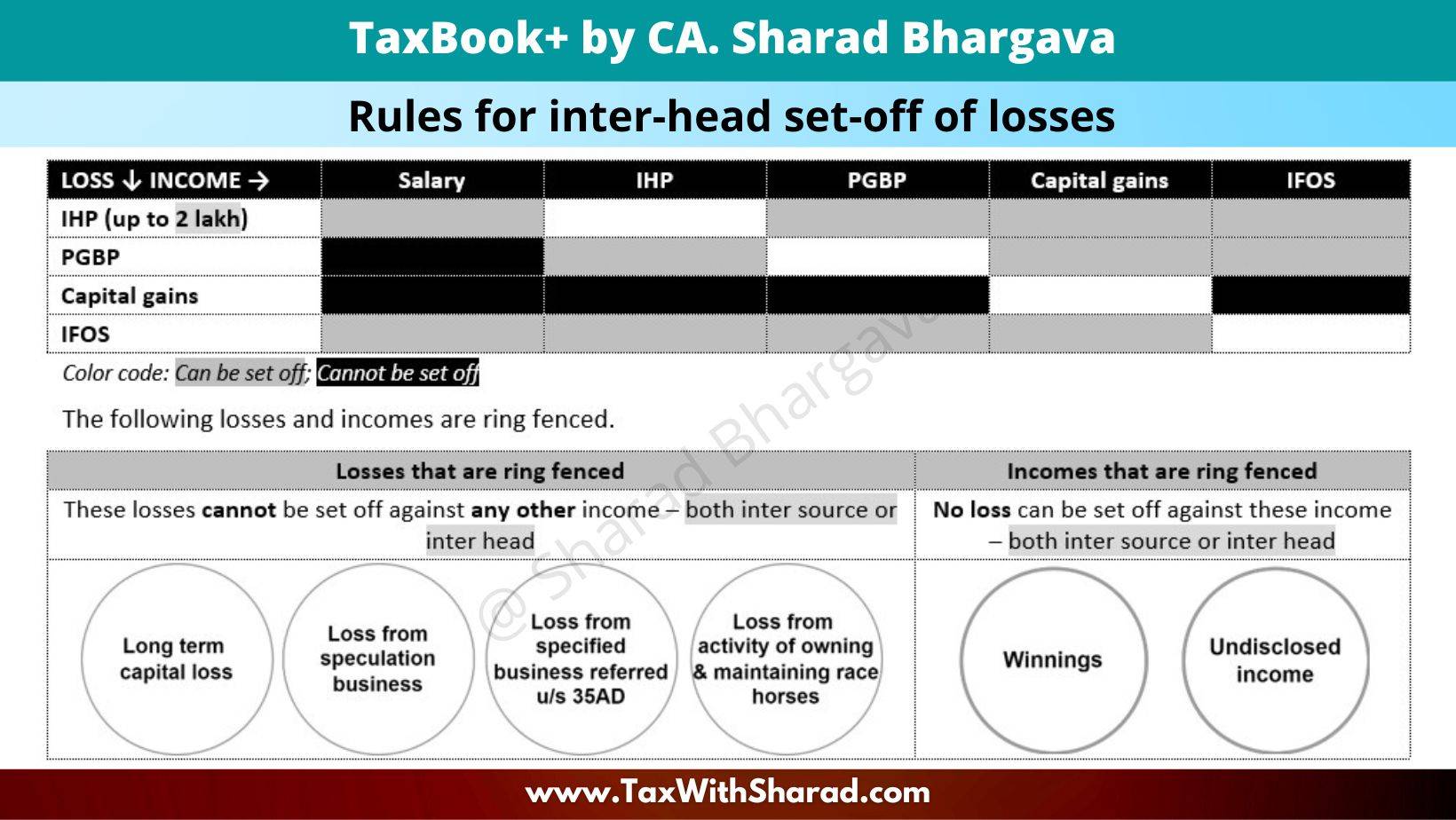

Fast Track Revision (DT)/ 11 - Set-off & C/fd of Loss / CA Inter May/ Nov 2023 / CA. Sharad Bhargava

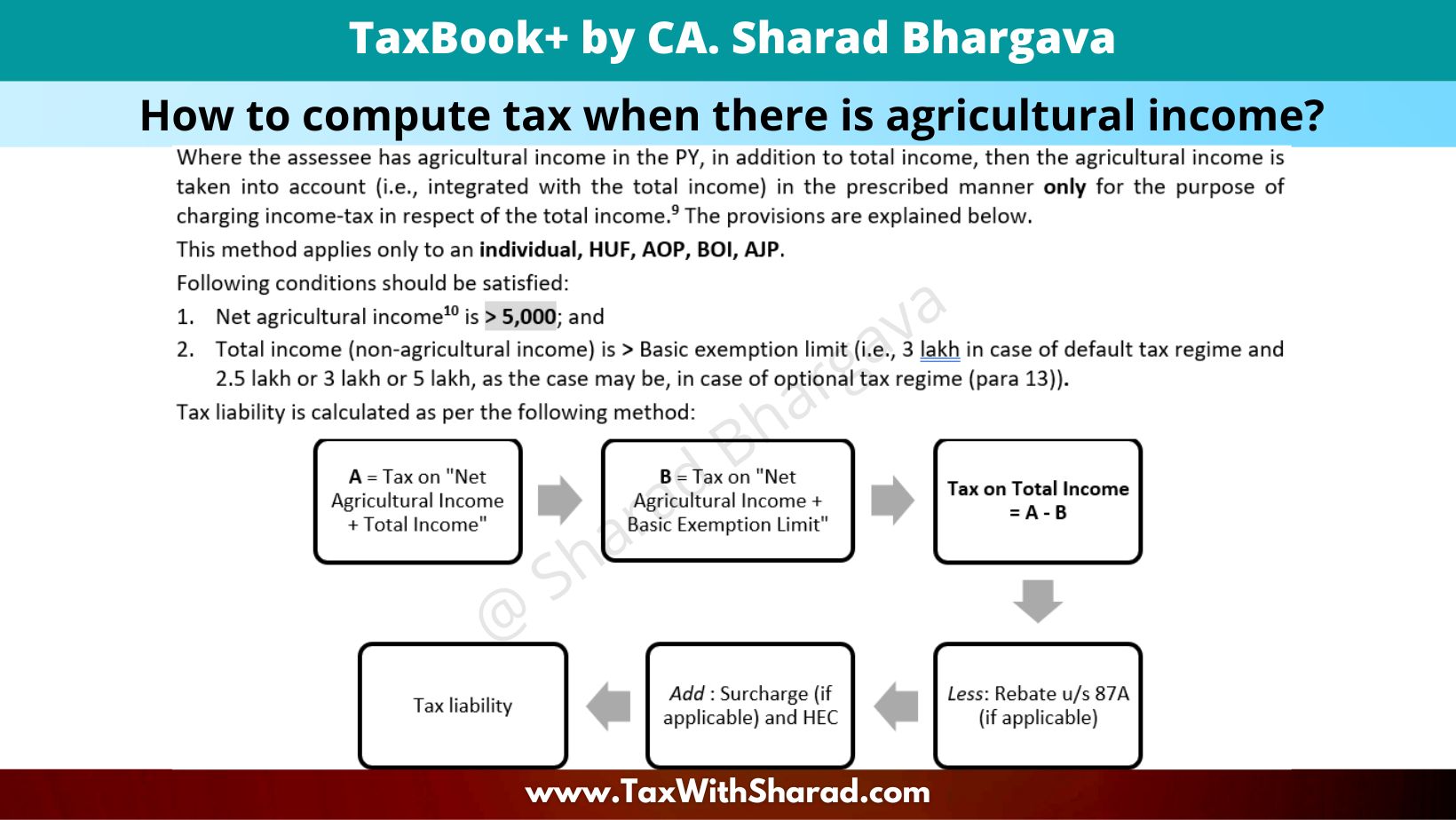

(English) / Apportion composite agricultural income as exempt & taxable income / CA. Sharad Bhargava

(Hindi) / Apportion composite agricultural income into exempt & taxable income / CA. Sharad Bhargava

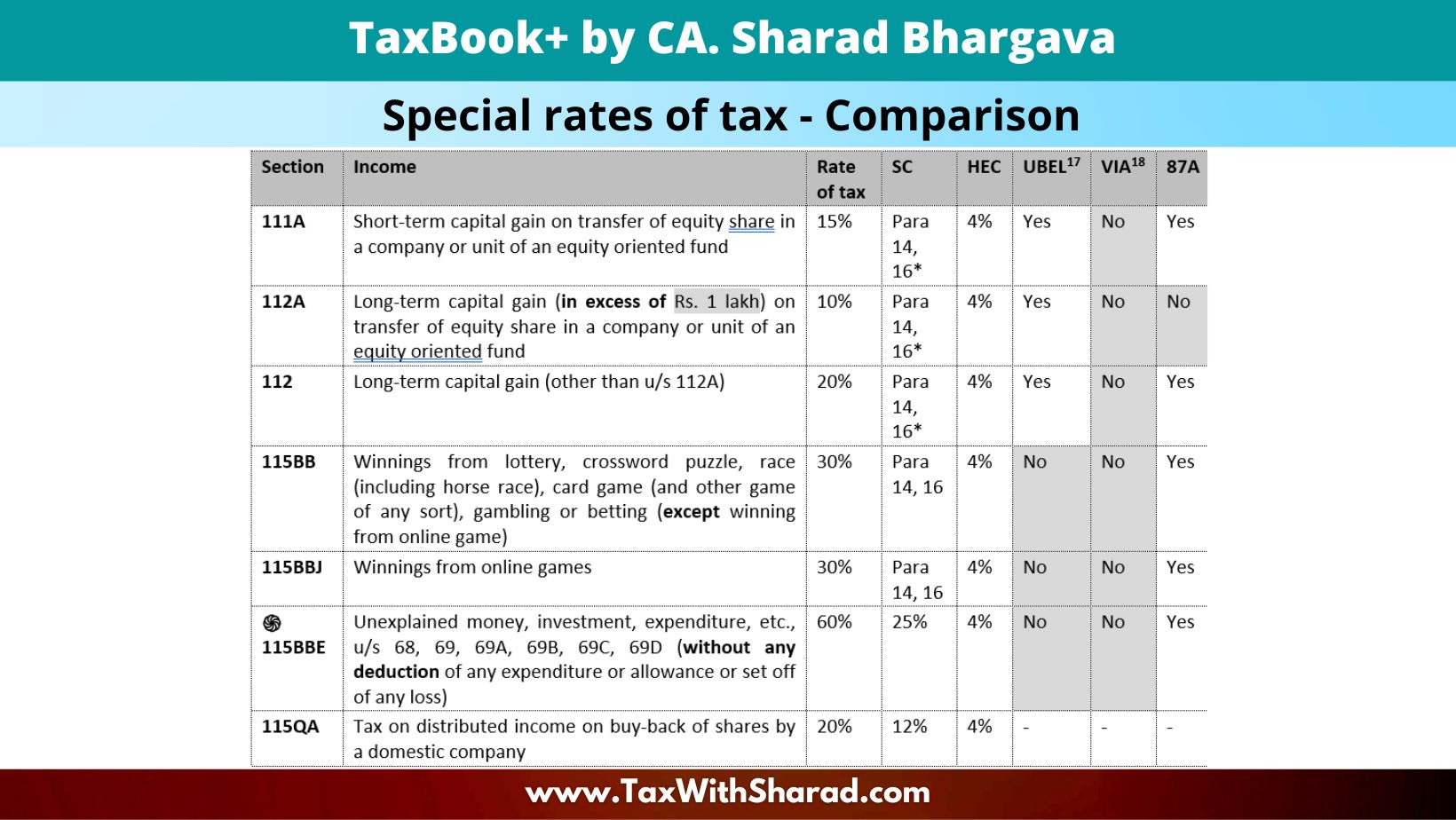

How to correctly compute tax on special rate incomes / Solved Questions & Tips / CA. Sharad Bhargava

Learn from Top Mistakes made in CA Inter May 2023 Tax Exam / Examiner Comments / CA. Sharad Bhargava

CA Inter May 24 / Important Announcement by ICAI / What is Included & Excluded / CA. Sharad Bhargava

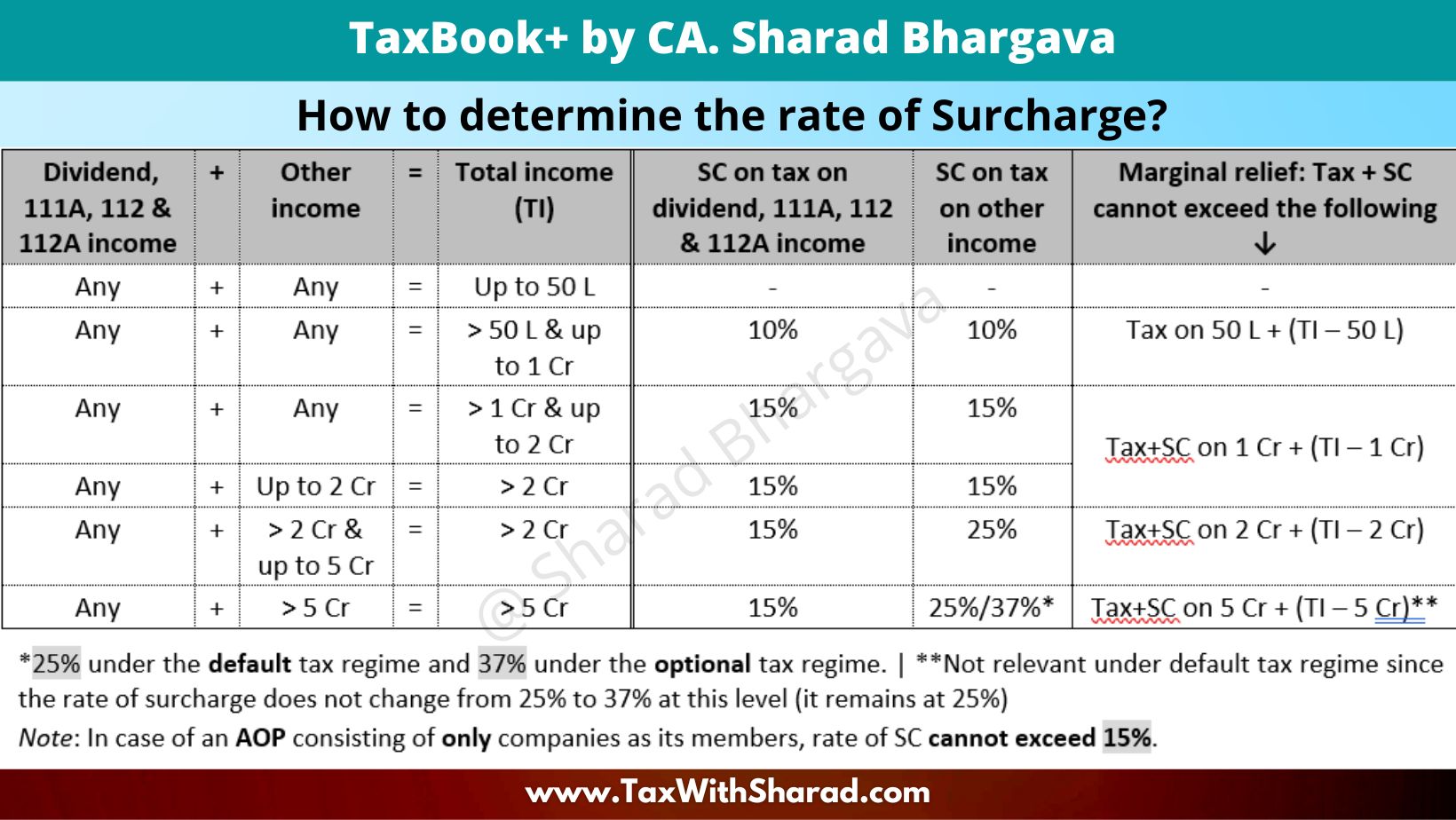

Limit of Surcharge on Tax on Long Term Capital Gain u/s 112 // How to compute // CA. Sharad Bhargava

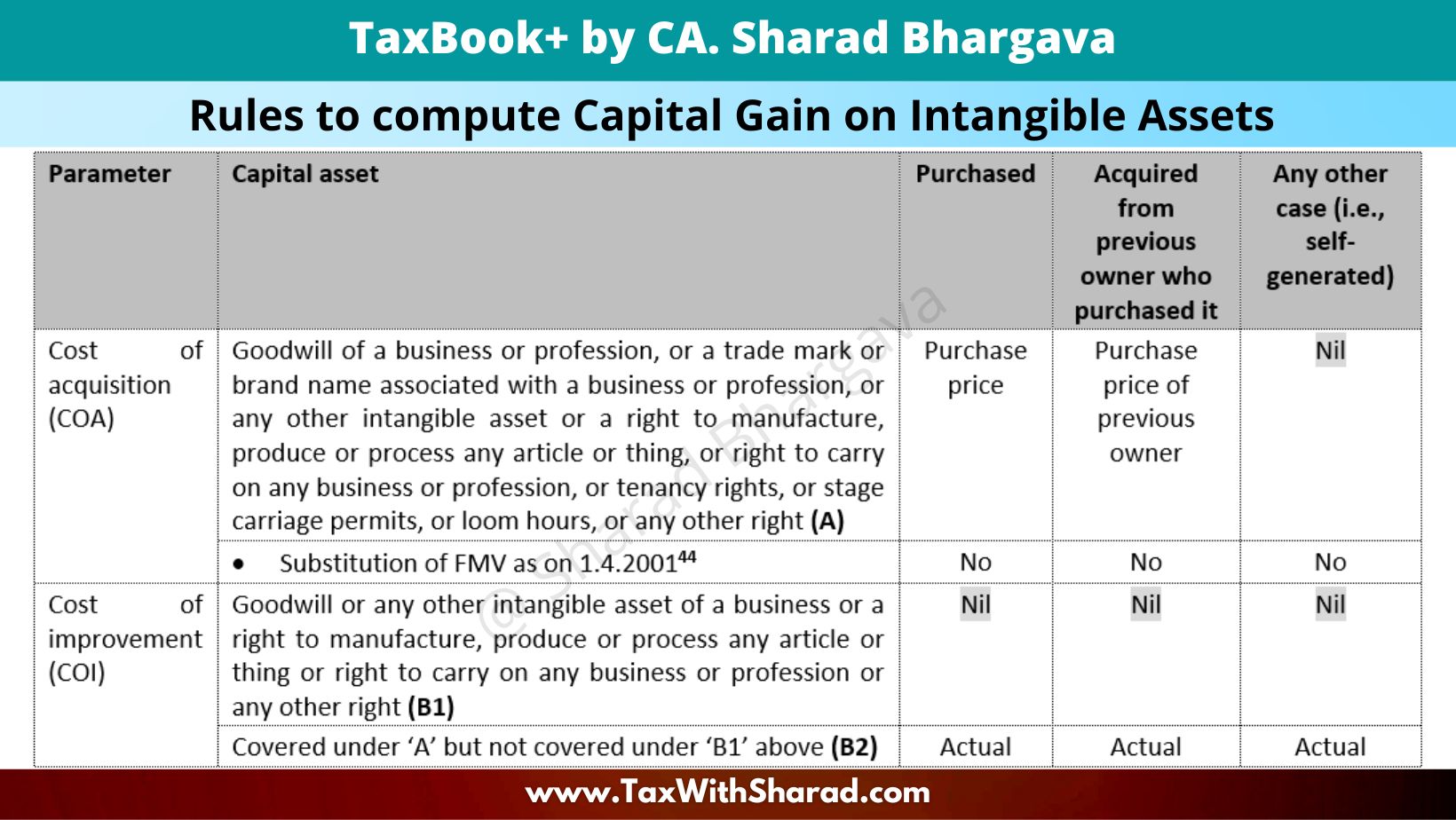

Can I take FMV of capital asset acquired after 31 March 2001 as it's Cost? // By CA. Sharad Bhargava

HRA exemption when factors change mid-year // What was asked in ICAI exam? // By CA. Sharad Bhargava