Product Details

Tax With Sharad's

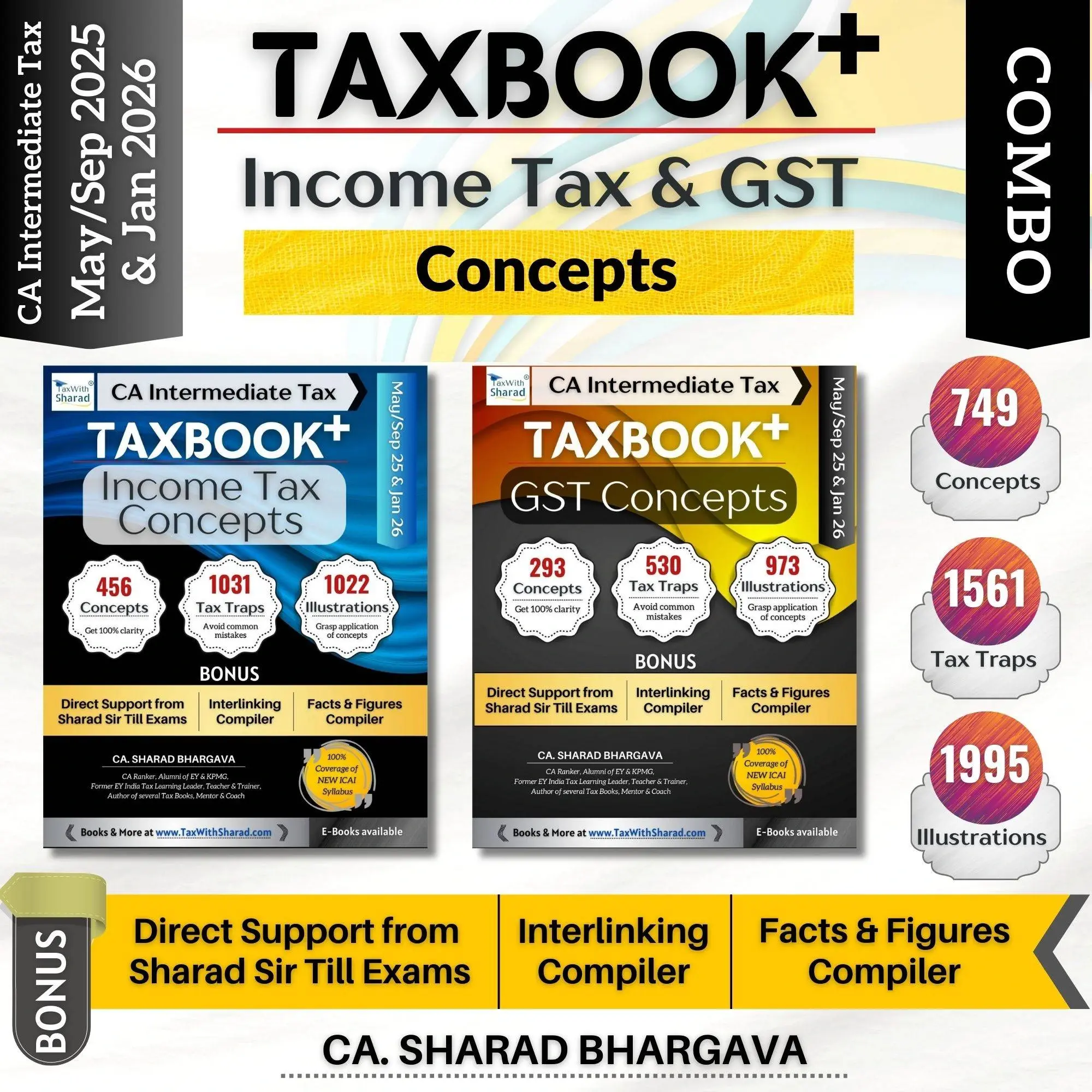

TaxBook+ Combo | Income Tax & GST - Concepts | Set of 2 Books | AY 2025-26

-

By: CA. Sharad Bhargava

-

For: CA Inter May/Sep 2025 & Jan 2026 Exams

Sharply exam-oriented Combo Set of 2 Workbooks on Concepts for Income Tax and GST. Covers Concepts, Tax Traps, Illustrations. // As per New Syllabus // With Larger Font Size, Easy on Eyes!! // Scroll down for Sample, Facts & Figures, Bonus and Powerful Tools for 100% Success.

Bonus

Paperback (physical book) |

₹1163

₹1550

(25% Off)

|

|

E-book format (12 months access) |

₹775

₹1550

(50% Off)

|

|

Links in ‘Table of contents’ are not functional in the sample since the sample does not contain the entire content. Links are functional in the full E-Book.

If you purchase "Paperback Book" it will be shipped to your doorstep. If you purchase "E-Book" it can be accessed instantly.

Facts & Figures

100% coverage of syllabus

Get 100% clarity

Avoid common mistakes

Grasp application of concepts

Bonus

Direct Support from Sharad Sir

Ask Tax doubts & clear concepts from Sharad Sir till your exams

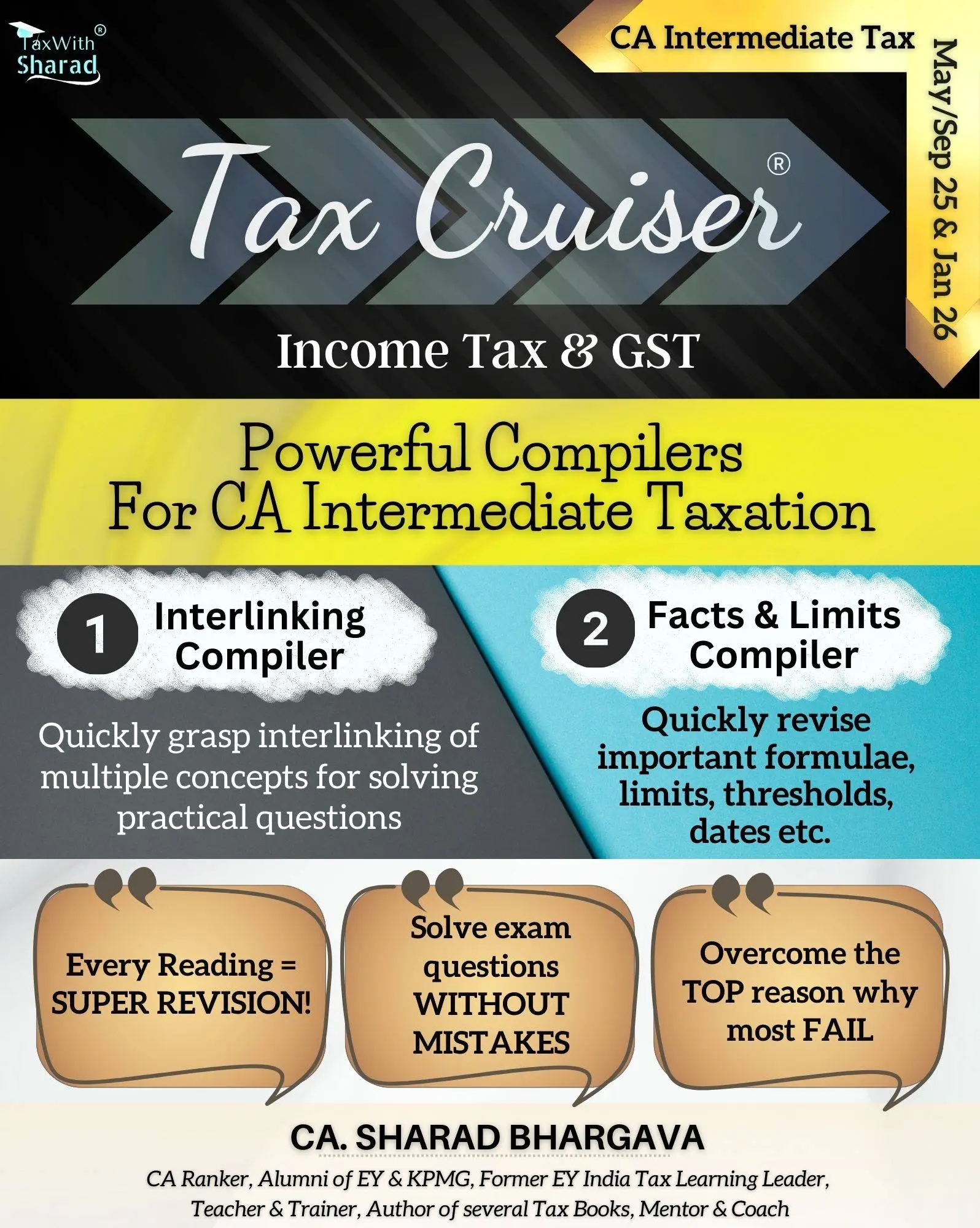

Learn MoreTax Cruiser

Powerful compilers for CA Inter tax (Interlinking Compiler and Facts & Figures Compiler)

Learn MoreUpdates & Tips

Important updates & exclusive tips from time to time

Powerful Tools for 100% Success

Holistic approach

Powerful study material + Direct support from Sharad Sir + Tax Cruiser Compilers for Interlinking and Facts & Figures + Tax Max with Sharad Sir (YouTube Videos) + Updates & Tips = 100% Success!

100% coverage

100% coverage of NEW ICAI Syllabus & Study Material – Nothing more, nothing less. Everything you need!

Cut the flab

To the point & sharply exam oriented. Learn max in least time!

Tax Traps

Caution areas are highlighted. Steer clear & avoid common mistakes!

Tax Cruiser

Powerful Compilers for exam >> Interlinking Compiler and Facts & Figures Compiler

Video Tutorials

Watch videos on Statutory Updates, Exam Paper Solutions, ICAI MCQ & Case Scenario Solutions, Finance Act Amendments, Select Concepts, Updates & More! Get 100% clarity!

Illustrations

Numerous illustrations are provided covering all provisions. Fully grasp application of concepts!

Logic & reasoning

Logic & reasoning is highlighted for key provisions. Understand to learn better!

The non-tax side

Student Notes are given to explain important non-tax themes. Learn the practical side!

ICAI views

Fully aligned to ICAI views. Alternatives are also highlighted. Go with what ICAI says!

Charts & Tables

Numerous Charts & Tables are given for super simple, clear & quick learning.

Intelligent highlights

Key words & figures are highlighted for quick attention and speed revision.

Know what is asked

Topics asked in exam are highlighted so that you focus on ABC analysis.

Theme arrangement

Section-wise learning is ineffective. That is why content is arranged as themes so that you understand concepts rather than mere sections.